Smart Money-Saving Strategies

Saving money should be something you’re thinking about year-round, but with tax season on the horizon, finances are top of mind now more than ever. Whether you want to make room in your budget for home upgrades or start seriously saving for future plans, now is as good a time as any to get planning!

Home Is Where the Money Is

You want to save more, but where do you start? The answer can be found right in your own home. Implement these simple strategies to cut consumption and increase your monthly savings.

Lower utility use

Utility bills are a monthly expense every homeowner has to deal with, but the cost is not fixed. If you cut back on your water and electricity use, you’ll be able to save more of your hard-earned money. Every little bit helps, and small things like closing doors to eliminate wasteful energy use can make a big difference over an extended time. When it comes to the water bill, consider taking shorter showers, lowering the temperature on the water heater, and remembering to shut off the faucet anytime you walk away from it.Use a shopping list

Retailers have selling down to a science. Everything from the layout of the store to the height at which the items are displayed and even the sounds and smells are carefully chosen to get you to buy more. The best way to combat this is to go in with a specific list of what you need—especially at the grocery store. Better yet, look up coupons for these items before you go! And if the store brand is cheaper, consider that option. Often the quality is just as good.Go paperless

Paper towels, napkins, and plates aren’t major expenses, so you probably never give them a second thought. But did you ever think about how much they cost you over the course of a year or more? Compare that to the one-time expense of dish towels, cloth napkins, and reusable plates, and your choice is a no-brainer.-

Repurpose instead of buying new

There are plenty of ways to reuse things like old furniture and other household items that could save you money you might otherwise spend on more expensive goods. Here are some helpful blogs that detail how you can repurpose different items around the house:

Budget or Bust

Sticking to a budget is one of life’s necessary evils. While not always fun, it is an important responsibility that can help you better manage your finances. Here are some basic money-saving tips to start implementing into your daily life.

Set up a weekly allowance

Whether you get a paycheck every week or every other week, one of the best things you can do to start building your savings is reserve a set amount each week for extra expenses. Once that reservoir is gone, promise yourself you won’t dip into any other savings until the following week. It’s also wise to put the "extra" paycheck you get two months out of the year right into your savings (if you receive a biweekly paycheck.)Switch to home cooking

There’s nothing wrong with eating out every once in a while, but dining at restaurants and even stopping at the drive-through can add up over time. Try to plan out meals at the beginning of the week and shop accordingly. Don’t forget: stick to your shopping list!Make saving nonnegotiable

When you start to view a savings deposit as another one of your monthly bills that has to be paid, you might be surprised how much more valuable it will become to your budget. Treat this deposit as a necessity, not something you may or may not have to do. Your future self will be grateful.Keep those receipts

Instead of throwing away all of your receipts, store them in a folder or in a box to look through at the end of each month. This is a great way to see how much of your spending was essential and how much was wasteful. Once you figure out where you can cut or where you can be more lenient, work this into your weekly allowance.Choose cash over cards

If you’re stepping out for some shopping, consider leaving the credit and debit cards at home. Take out a set amount of cash at the beginning of the week, and once it’s gone, don’t take out more unless absolutely necessary. This isn’t a guarantee to put an end to wasteful spending, but it can help curb some of the unnecessary purchases you may have been more inclined to put on your credit card.

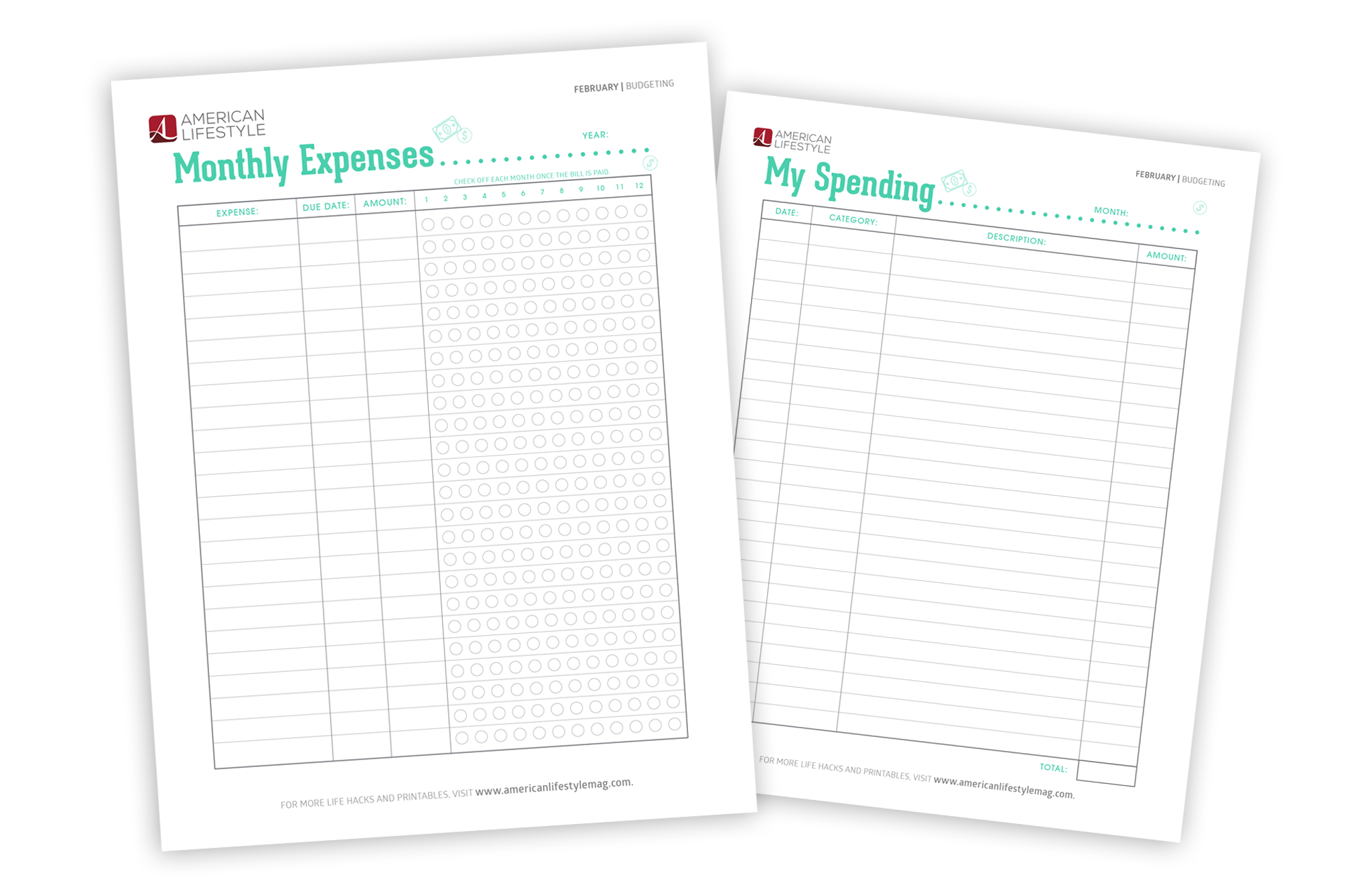

Download Budget Tracker

Download Budget Tracker

Posted in February 2020 on Dec 04, 2019